Microsoft Hikes Xbox Prices; Analysts Predict PlayStation to Follow

In recent weeks, the gaming industry has seen a wave of price increases across major platforms. Microsoft raised the prices of all its Xbox Series consoles and many accessories worldwide, while also confirming that some new games will cost $80 during this holiday season. Just a week prior, PlayStation raised console prices in select regions, and before that, Nintendo increased Switch 2 accessory prices and announced its first $80 game. These tariff-induced price hikes have been rolling out, and it can be overwhelming to keep track of all the changes. To understand this trend, I consulted several industry analysts who provided insights on why these increases are happening, how much more expensive gaming might become, and whether the industry is in jeopardy. The good news is that video games, consoles, and major platforms are not going away. The bad news? We're likely to see significant price increases across the board.

Why Is Everything So Expensive?

When I asked analysts why Microsoft chose this moment to raise its console and accessory prices so significantly, the answer was unanimous: tariffs. The rising costs of development and manufacturing play a role, but tariffs, or the fear of them, driven by U.S. President Donald Trump's fluctuating policies, are the main culprits. Dr. Serkan Toto, CEO of Kantan Games, Inc., remarked, “Microsoft's consoles are made in Asia, so seriously: who in this world can now be surprised about these price hikes?” He noted that while high prices were inevitable, the recent tariff chaos in the U.S. provided a strategic backdrop for Microsoft to announce these increases with minimal backlash. “It was a clever move from Microsoft to use the current economic climate as a backdrop to not only push the price hikes in the U.S. but also globally. What was also clever is that they did this in one fell swoop instead of riling up fans over a longer period of time and from one territory to the next.”

Joost van Dreunen, NYU Stern professor and author of the SuperJoost Playlist newsletter, echoed Toto's sentiments, explaining that Microsoft's approach was a strategic recalibration in response to tariff pressures. “Microsoft is ripping off the Band-Aid all at once rather than death by a thousand cuts. I read Microsoft's synchronized global price adjustment as a strategic recalibration in response to tariff pressures rather than incremental market testing. By implementing comprehensive increases across hardware, subscriptions, and first-party titles simultaneously, they're consolidating consumer reaction into a single news cycle while attempting to maintain their pricing position relative to competitors in what's becoming an increasingly service-oriented market where hardware is merely the entry point.”

Other analysts, including Manu Rosier from Newzoo and Rhys Elliott from Alinea Analytics, also emphasized tariffs as a primary factor. Rosier highlighted the timing of the price increase ahead of the holiday season, allowing Xbox’s partners and consumers time to adjust. Elliott pointed out that while digital software isn't directly impacted by tariffs, the price increase on games helps offset the higher costs of hardware manufacturing due to tariffs. “If costs increase in one part of the business, balancing the books elsewhere is necessary. That’s largely what’s going on here.”

Piers Harding-Rolls from Ampere Analytics added that macroeconomic factors, such as persistent inflation and supply chain cost increases, also contribute to the price hikes. “The macroeconomic backdrop is also a contributing factor, with higher-than-expected persistent inflation and increases in supply chain costs. The launch price of Switch 2 and Sony’s recent price hike will have made it easier to move now. It’s also not a surprise that the company waited until after the earnings announcement. I think Microsoft probably saw a significant gap between its entry level pricing and that of PS5 and Switch 2. Even with a 27% increase in the U.S., the cheapest Xbox Series S console is $70 cheaper than the Switch 2, so there was a lot of headroom there. The increases are generally the heaviest in the U.S. in percentage increase terms and I think we can lay that at the door of the tariff policy. Beyond the U.S., price increases in the EU and UK are generally more sedate and are more heavily focused on the cheaper consoles in the portfolio.”

Blinking Third

The big question on everyone's mind is whether Sony will follow suit with price increases on PlayStation hardware, accessories, and games. Most analysts I spoke with believe it's highly likely. Rhys Elliott was particularly confident, especially regarding the future of $80 games. “This is just the beginning,” he said. “On top of the hardware price hikes, we’ll likely see PlayStation increasing software prices as well. With Nintendo and Xbox raising software prices, the floodgates are now open. Every publisher — first- and third-party, PC and console alike — that can charge $80 will charge it. The market will bear it. Plenty of gamers are willing to pay price points above $70, as shown by the high numbers of those willing to pay $100 for a few days’ early access (which can be in the millions for some games, as per our data).”

Elliott also suggested that this higher ceiling could lead to more varied pricing, with games at different price points like $50, $60, $70, and others, allowing lower-priced games to sell more copies due to perceived discounts. (Notably, after our discussions, EA specifically said it would not raise prices on its games... for now.)

Daniel Ahmad from Niko Partners noted that while Sony has already raised console prices in certain regions, the U.S. might be next. “Sony has raised the price of its console multiple times outside the U.S.,” he said. “There is a reluctance from both Sony and Microsoft to raise prices in the U.S. given the size and importance of the market when it comes to console sales. That being said, we would not be surprised to see Sony follow suit with price increases on the PS5 in the U.S.”

James McWhirter from Omdia added that Sony's supply chain, predominantly based in China, is at risk due to U.S. tariffs. “PS5 hardware is predominantly manufactured in China, exposing Sony's supply chain to greater risk from tariffs originating from the U.S.,” he said. “Yet what we consistently observe in the console market is that up to half of consoles are typically sold during Q4, the final quarter of the year. This bought both Microsoft and Sony more time to rely on existing inventories. In 2019, consoles were granted an exemption from tariffs on goods from China, but this ruling did not come into effect until August. With Microsoft having blinked first with price readjustments this week, it now opens the door for Sony to follow with PS5. This is going to be a particularly tough decision in the U.S., the world's largest console market, which has historically been spared — save for PS5 Digital rising by $50 in late 2023.”

Mat Piscatella from Circana was less definitive about Sony's next move but pointed to the Entertainment Software Association's comments on the impact of tariffs on video game prices, suggesting that rising prices are “the symptom, not the disease.” Meanwhile, Nintendo indicated it may consider “what kind of price adjustments would be appropriate” if tariffs continue to fluctuate.

Video Games Are Fine... But Are We?

With Xbox's price increases and the potential for Sony to follow, there's concern that these changes could harm console manufacturers. However, analysts I spoke with don't see this as a significant issue. Microsoft's 'This Is An Xbox' campaign indicates that the company has been preparing for this shift for some time. While fewer people might buy Xboxes, the company's hardware sales have been declining, and it's transitioning to a service platform rather than relying solely on hardware sales. Plus, there's always the excitement around upcoming releases like GTA 6.

Piers Harding-Rolls noted, “Xbox hardware sales revenue has been in decline, and I see that continuing, moderated to an extent by the higher price points. We expect a boost in Q2 2026 due to the launch of GTA 6. Last quarter Microsoft gaming hardware sales fell by 6% and the prediction is for a further drop next quarter. Overall, I think higher prices have some dampening effect, but the delay of GTA 6 is probably more significant in terms of 2025 performance.”

Analysts generally believe that while spending patterns might shift, overall spending on games won't decrease significantly. Rhys Elliott explained, “The rising prices won’t necessarily reduce spending. Even in the toughest of economic times, games are incredibly price-inelastic. The market will bear it. Early adopters will always be early adopters. PlayStation and Nintendo console sales have been tracking above or in-line with previous generations, despite consoles not dropping in price like previous generations. PlayStation actually increased its unit prices for the PS5, while Nintendo did for the Switch more stealthily by charging more for the OLED model. What’s more, in-app purchases generate vast spending these days — more than premium game purchases when looking at the market as a whole.”

Manu Rosier agreed, suggesting that as prices rise, consumers might become more selective, spending more on subscriptions, discounted bundles, or live-service games rather than individual full-priced titles. “Not necessarily a decline, but we may see shifts in where and how money is spent. As prices rise, consumers may become more selective — spending less on individual full-priced titles and more on subscriptions, discounted bundles, or long-tail live-service games. The total spend may remain steady or even grow modestly, but the distribution across formats and platforms will likely continue to evolve. Xbox’s pricing changes, and similar moves by others, could accelerate this transition toward services and ecosystems over standalone product purchases.”

Piers Harding-Rolls added that the U.S. might feel more of the impact due to its large console market and the localized tariffs. Daniel Ahmad suggested that Asian and MENA markets could still see growth, particularly in countries like India, Thailand, and China. James McWhirter noted that while full game prices have not historically followed inflation due to consumer pushback, Xbox's move to $80 games so soon after Nintendo indicates that more publishers will likely follow suit. “Importantly, we don't expect this to directly impact sales volumes, especially given 2025's high-quality content pipeline — but publishers will continue to explore ways in which they can add value post-release. Many already do this via frequent discounting, multi-tiered pricing strategies, DLC, bundling. On the platform holder side, companies like Nintendo can always pull the right levers after launch — we expect Nintendo Switch Online Game Vouchers to make a return at a higher price point to accommodate $80 games.”

Mat Piscatella was less optimistic but echoed the general sentiment of uncertainty that has been prevalent since tariff discussions began. “My expectation for the remainder of the trade war is that consumers will shift even more towards free-to-play and other more easily accessible forms of gaming, including games they already own or have access to,” he said. “Games like Fortnite, Minecraft, Roblox, etc will likely see even more players and hours spent in their ecosystems. Players will also rely on and continue to play devices they already own a bit more rather than buy new hardware. And, as prices rise in everyday spending categories like food, gas, shelter, automotive, etc, there will be fewer and fewer dollars available for categories like gaming in the U.S. I was trying to hold on to the +4.8% outlook I had at the beginning of the year for as long as I could, but that's looking more and more foolishly optimistic every day. Can easily see a high single-digit percentage decline, or even into the teens, depending on the other dominoes that fall when it comes to pricing. The error bars on any forecast are bigger now than they've ever been given the uncertainty in the market.”

-

1

Every Pokémon Game on the Nintendo Switch in 2025

Feb 25,2025

-

2

Roblox: Trucking Empire Codes (January 2025)

Mar 05,2025

-

3

Poring Rush, the casual battling spin-off from hit MMORPG Ragnarok Online, is out now

Dec 30,2024

-

4

How To Read Black Panther Lore: The Blood of Kings in Marvel Rivals

Mar 01,2025

-

5

![Anime Vanguards Tier List – Best Units For Each Gamemode [UPDATE 3.0]](https://images.gzztb.com/uploads/35/17376012656791b0f12fa1c.jpg)

Anime Vanguards Tier List – Best Units For Each Gamemode [UPDATE 3.0]

Feb 27,2025

-

6

Ragnarok X: Next Gen - Complete Enchantment Guide

May 25,2025

-

7

Nvidia RTX 5090 Specs Leak: Rumor Confirmed?

Mar 14,2025

-

8

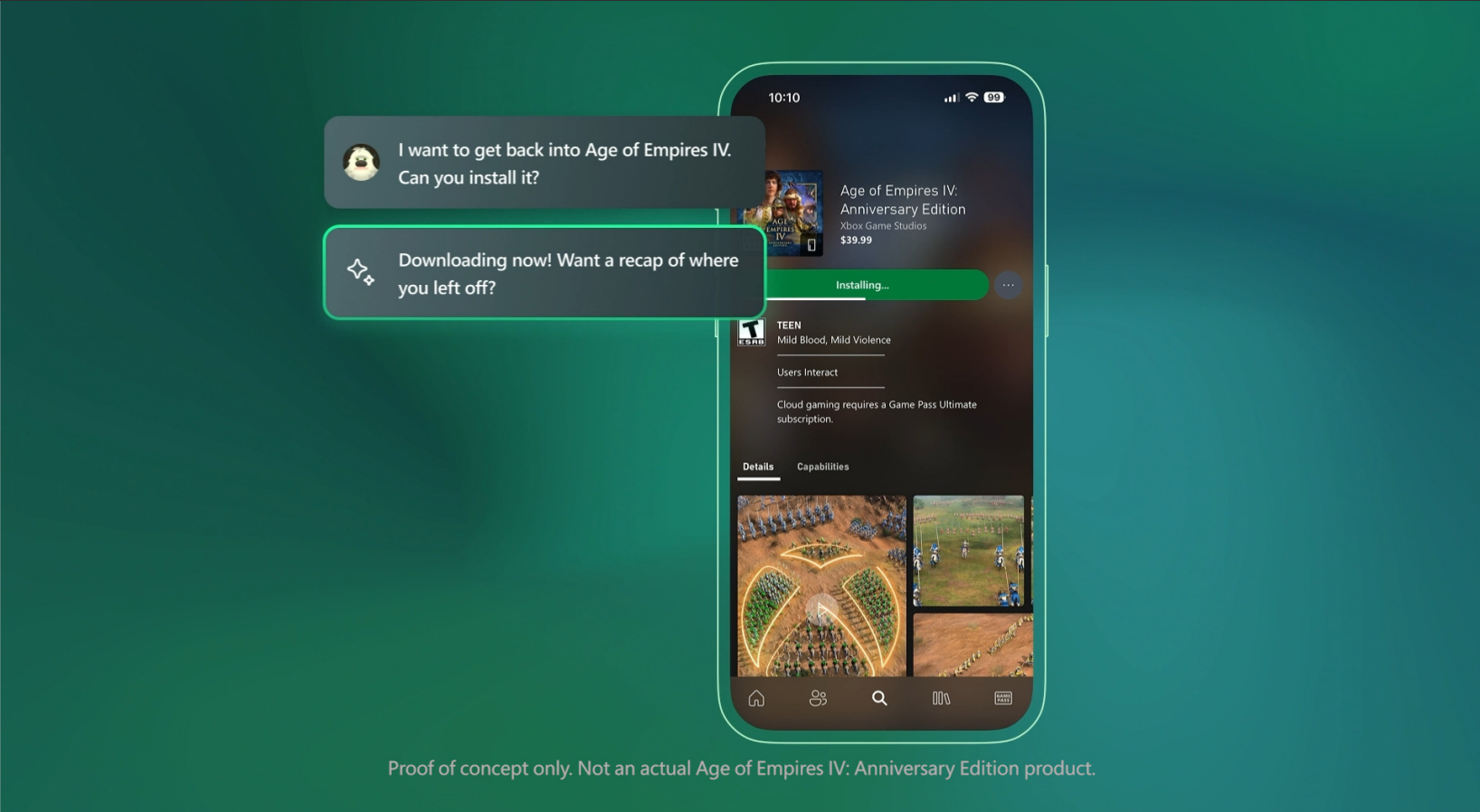

Microsoft to Integrate Copilot AI into Xbox App and Games

May 21,2025

-

9

Stardew Valley: A Complete Guide To Enchantments & Weapon Forging

Mar 17,2025

-

10

Hearthstone has kicked off the Year of the Raptor with a myriad of new content

Mar 16,2025

-

Download

The Golden Boy

Casual / 229.00M

Update: Dec 17,2024

-

Download

Niramare Quest

Casual / 626.43M

Update: Feb 21,2023

-

Download

POW

Casual / 38.00M

Update: Dec 19,2024

-

4

Mother's Lesson : Mitsuko

-

5

Gamer Struggles

-

6

Poly Pantheon Chapter One V 1.2

-

7

How To Raise A Happy Neet

-

8

Dictator – Rule the World

-

9

Strobe

-

10

Livetopia: Party